How to Calculate Borrowings in Cash Budget

Like any other financial statement we begin the cash budget with the titles. This figure represents the amount you have available at the very beginning.

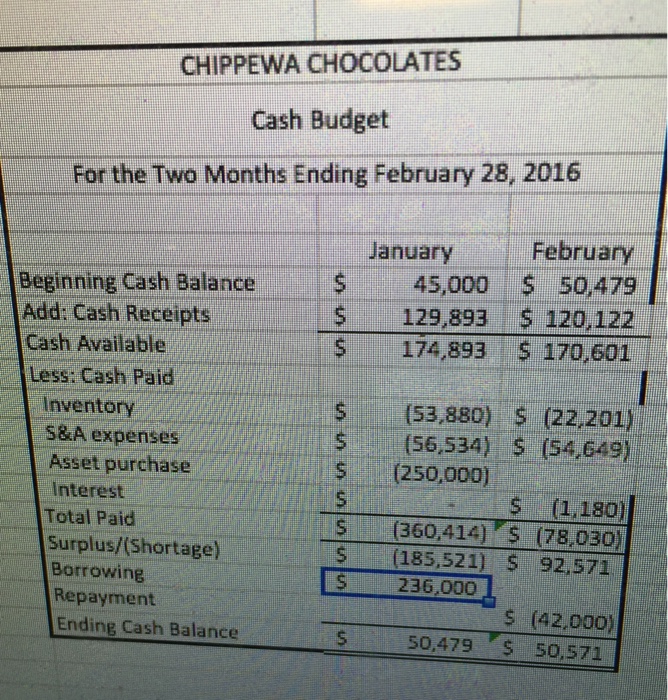

Solved Chippewa Chocolates Cash Budget For The Two Months Chegg Com

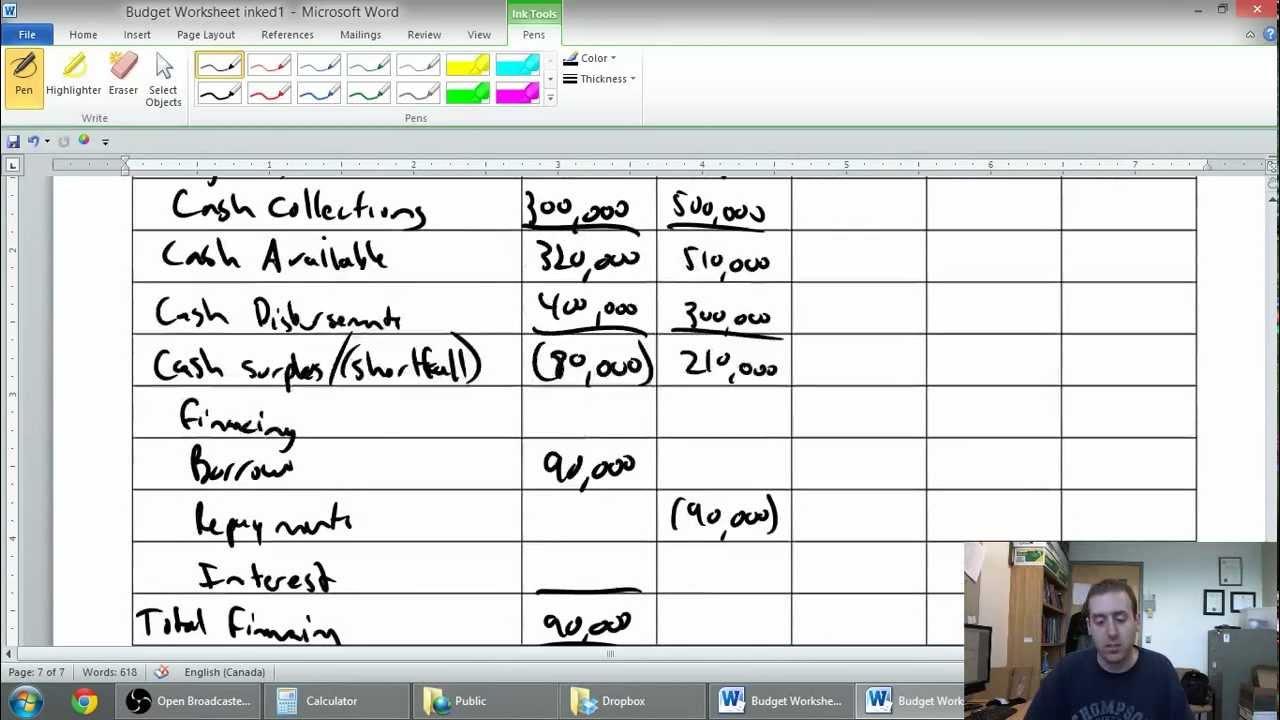

Calculate the amount of cash to borrow based upon a cash budget Cash Budget Beginning Cash Balance Cash Receipts Collections from customers Sale of Securities Total Receipts Total available Cash-Cash disbursements Inventory Salaries Selling and administrative expenses excluding depreciation Purchase of truck Income tax expense Total disbursements Excess.

. How to calculate borrowing in the financial section of Cash Budget. To calculate your beginning cash balance for a cash flow statement add all of the sums of capital available to your business at the beginning of the period covered by the statement. I The following sales figures are for the months of November 2015 to June 2016.

45 Votes Combining the two equations together gives you the budget balance equation by isolating the government budget term expenses minus income. They requested their accountant to prepare a cash budget for the four months ending 30 April 2016. Subtract the total expected cash payments from the total cash amount to find the ending cash balance.

Prepare a cash budget for the quarter ended March 31 2016. Cash budget helps the managers to determine any excessive idle cash or cash shortage that is expected during the period. CHIPPEWA CHOCOLATES Cash Budget For the Two Months Ending February 28 2016 January February Beginning Cash Balance Add.

Quarter of sale 80 is 3200000. 485 2641 Views. That discount rate can either be the leases implicit rate or if unavailable the incremental borrowing rate.

The cash budget starts with the beginning cash balance to which is added the cash inflows to get cash available. If the enterprise has shown a stable relationship between cash and sales or cash and cost of sales it is an appropriate ratio to select for a minimum balance. An analyst must take these dimensions into account when budgeting or forecasting the minimum-cash component.

So before getting into the incremental borrowing rate the first step is to try and calculate the rate implicit in the lease. This video explains what the cash budget is in Managerial Accounting and demonstrates how to put together a cash budget with a comprehensive exampleEdspira. Short-term borrowings at 1 interest per month will be used to accomplish this if necessary.

This budget takes into account all the probable sources from where the company can earn cash over the budget period. You should find that which means the government excess money is savings minus investments minus net exports. Receipt and Payment Method.

Sales unit Q1 40000 Selling Price is 10000 per unit. With a cash flow budget the manager has an initial cash position for each time period. The financing section also includes debt repayments including.

Borrowings in multiples of 1000 will be made at the beginning of the month in which they are needed with interest for that month paid at the end of the month. Cash Flow from Financing Activities Formula 10000. This amount is found by adding the total of all borrowings and subtracting cash on hand.

Click on the total payment amount in our left-hand data table B11 on my sheet 4. I no my next quarter sale and not collectible will count in quarter 2-4. Include cash in the bank and cash on hand whether these sums came from sales or loans.

Such information helps the managers to plan accordingly. You now have a balance of 11000 due for the loan 20000 - 9000 repaid. Open a new workbook and rename Sheet1 to Cash Budget.

It is 10 per annum and you had it for 2 quarters or 12 a year. Were concerned about the the companys cash flow. This also leaves you with 15000 not 15325 in your cash balance.

It enables the manager to know and plan borrowing needs and investment opportunities throughout the year. In this example you would subtract 57500 from 75000 to get an ending cash balance of 17500. Cash Paid S45000 s 50479 129893 S 120122 S174893 S 170601 S 53880 S 22201 S56534 s 54649 Inventory SA expenses Asset purchase Interest Total Paid.

The figures from January 2016 onward are estimated. It can also serve as a communication tool to share with a lender to set up a line of credit make capital investments. And in A3 enter.

For the Period June to September 2012. Now in the first mortgage cell under January in our cash flow budget B13 we are going to enter a reference formula. The total for this example would be 57500 in expected cash payments.

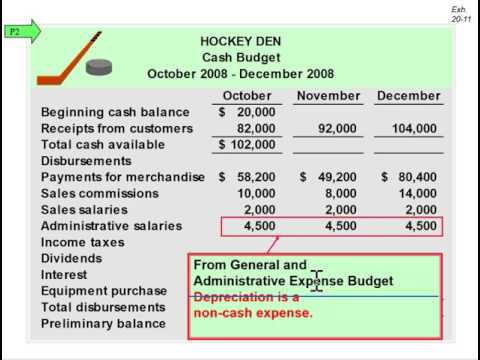

Under this method all Cash receipts and disbursements for the enterprise for a budget period are estimated. Cash Dividends Paid Dividends increase in dividends payable -17000 10000 -7000. Cash outflows for the period are then subtracted to calculate the cash balance before financing.

Cash Receipts Cash Available Less. Cash budget is a financial budget prepared to calculate the budgeted cash inflows and outflows during a period and the budgeted cash balance at the end of the period. Type equals 2.

The cash flow budget is a valuable planning tool for the farm manager. Next enter the names of the months from. Net borrowings is shown on the statement of cash flows under financing activities.

To calculate that present value the lessee needs a discount rate. Cash Inflow Forecast. The calculation would be 20000 10 12 1000.

That leaves 9000 available for repaying the loan. If this balance is below the companys required balance the financing section shows the borrowings needed. Preparing a cash budget requires information about cash receipts and cash disbursements from all the other operating budget schedules.

Click on the Loan Calc tab. Completing a Cash Budget. Thereafter all estimated cash receipts are added to the opening balance of cash and all estimated cash payments are deducted from this to arrive at the closing balance of cash.

Cash budget After the preceding analyses have been prepared sufficient information is available to prepare the cash budget and compute the balance in the Cash account for each quarter. Center these titles across columns A to I. Press F4 on the keyboard to make the reference absolute 2 dollar signs will appear in the formula.

My total sales are 400000. These sources include cash sales cash to be received against accounts receivables cash to be generated from the sale of a fixed asset over the period cash to be earned from the sale of stocks and bonds or any other. The directors of Kingston Co.

Budgeting minimum cash balance. Paul Borosky MBAFor a downloadable cash budgeting template. Click to see full answer.

Net Borrowings on the Statement of Cash Flows.

Solved How Do You Calculate Borrowings In The Bottom Of The Cash Budget Course Hero

No comments for "How to Calculate Borrowings in Cash Budget"

Post a Comment