Which Best Explains How a Budget Deficit Develops

Represents government borrowings from the domestic market and is the best measure of budgetary health of a country. A budget deficit occurs when tax revenues are insufficient to fund government spending meaning that the state must borrow money usually in the form of government bonds.

Less Skewed Accounting Data Visualization Charts And Graphs

The deficitsurplus is the difference between the level of government purchases and the level of receipts.

. A budget surplus or a budget deficit is used to record the difference between national government revenues and expenditures. Learn more about the factors impacting the federal budget. The federal budget deficit was about 28 trillion in fiscal 2021 when Democrats passed Bidens 19 trillion American Rescue Plan Act.

The United States has carried a budget deficit far more often than a budget surplus over the past 50 years. Sponsors have a good idea of what a project should cost and generally know when you are over or under. There is a particular level of economic activity such.

A complete and realistic budget justification demonstrates that your project is well conceived. Such deficit may be met by raising the rates of taxation or by the charging of higher prices for goods and public utility services. In this case government spending of 300 billion baht is more than tax collected of 21 trillion baht only.

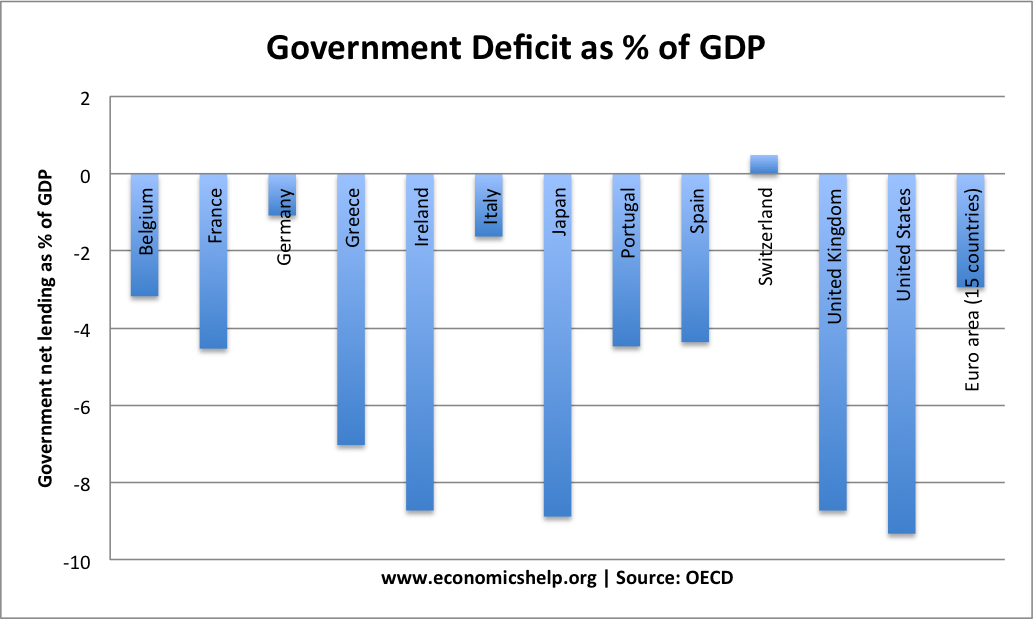

The results are typically presented as a percentage of the Gross Domestic Product GDP. Explain how an increased federal budget deficit resulting from a recession can actually help stabilize an economy. A well-developed budget is accompanied by a budget explanation.

In actuality it reached 28 trillion for the fiscal year 2021. The 2020 deficit of 31 trillion as a result of the COVID-19 pandemic takes the top spot. A budget transmittal letter from the superintendent which provides the overall context for budget development at the school level A budget overview which explains the budgeting philosophy and approach outlines the budget development process and refers to major assumptions and changes in the budgetary process from the previous year.

A budget deficit is the difference between what you intend to spend in a year and the revenue you have to spend. Which of the following explains how Treasury bonds can have an effect on the size of the money supply. Summary of effects of a budget deficit.

The government can bridge budget gap from three sources. A budget deficit is the annual shortfall between government spending and tax revenue. The deficit is the amount a government spends above what it brings in.

If you spend 11 trillion but you have raised only 1 trillion then you will have a deficit for that year of 100 billion. Assignment Details Assignment 2 Markets and the Economy You are to write a four to eight 4-8 page report that answers the following. A budget deficit arises when the estimated expenditure exceeds estimated revenue.

Federal budget deficit was projected to reach 23 trillion in 2021. However size of the deficits have increased dramatically even accounting for inflation. The budget deficit or fiscal gap is a common scenario of almost all the underdeveloped countries across the world but the magnitude of the deficit is comparatively higher in developing countries.

Budget deficit total expenditure total receipts Revenue deficit revenue expenditure revenue receipts Fiscal deficit total expenditure total receipts except borrowings Primary deficit Fiscal deficit - interest payments Effective revenue deficit Revenue deficit grants for the creation of capital assets. If the net revenues were negativemeaning total expenses exceed total revenuesthis would exemplify a budget deficit. A governments budget deficit causes debt to increase.

It is predicted to collect revenues of 21 trillion baht but the Government has set a deficit of 300 billion baht. Deliverables You will post your report document to a dropbox. The existence of Treasury bonds increases competition among banks to offer low-interest loans C.

The deficit is primarily funded by selling government bonds gilts to the private sector. This will leads to a budget deficit. A governments budget deficit causes debt to decrease.

Governments in many countries run persistent annual fiscal deficits. The government can avoid running a budget deficit and reducing the money supply by issuing Treasury bonds B. The main factor that cause deficit in the budget is the revenue deficit - the difference between revenue receipts and revenue expenditure in an accounting sense.

Generally expansionary policy leads to higher budget deficits and contractionary policy reduces deficits. Debt requires a government to pay back more than it has borrowed. This would require the government entity to review actual spending identify opportunities to reduce expensesincrease savingsor increase revenue to balance the budget.

Budget deficit is when government spending is more than tax collection. Rise in national debt. The deficit is positive when GDP is low but the budget goes into surplus when GDP is sufficiently high.

Higher debt interest payments. The deficit is the annual amount the government need to borrow. It also tends to minimize the chances that sponsors will arbitrarily reduce or eliminate budget categories.

In order to indicate whether the balance is a surplus or a deficit positive numbers are shown in the cases of surpluses while negative -. 1 It was the second-highest deficit since 1945. Key Takeaways Governments use fiscal policy such as government spending and levied taxes.

The deficit may also be met out of the accumulated cash balances of the government or by borrowing from the banking system.

Why Mobile Application Development Is Required By Enterprises Application Development Mobile Application Development Mobile Application

No comments for "Which Best Explains How a Budget Deficit Develops"

Post a Comment